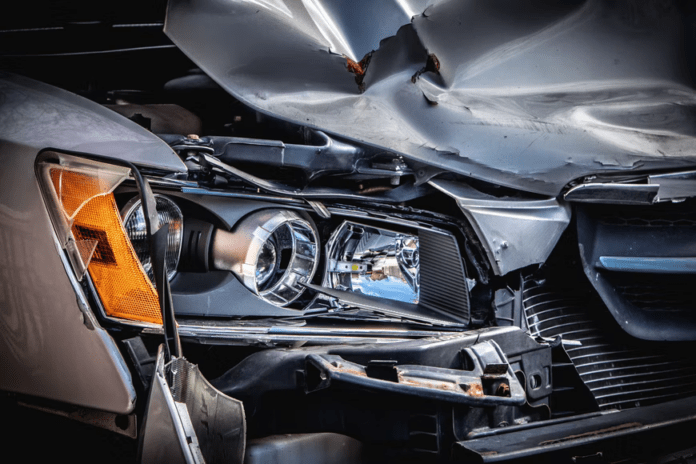

With millions of car accidents occurring every year in the U.S. alone, and tens of thousands resulting in tragic fatalities, it is important you have car insurance to cover things like damage to your vehicle and medical bills for your injuries.

Let us take a closer look at your medical bill payment responsibility after being involved in a car accident.

Insurance Companies Pay the Claimant

If you are injured in a car accident, it is important you seek medical help straight away.

Once your injuries have been treated, you need to look at how your insurance coverage affects your medical bill payment.

First off, you should know car insurance companies do not pay the amount of the medical bills directly to the hospital or doctor, regardless of whether it is your insurer or the other driver’s insurance company that is responsible for paying.

Insurance companies only pay the claimant: you. And that only happens if there is a settlement.

Sometimes claims can be refused, in which case you should seek advice from a professional law firm like lawampm.com.

In fact, it can be useful to have an attorney on board from the get-go to help you navigate insurance claims and settlements.

Your Medical Bills Do Not Have to Be Paid Ongoingly by the At-fault Driver

Even if you are injured in a car accident in which the other driver was at fault, the responsible driver does not have to pay your medical bills ongoingly.

If the driver is found to be at fault in court, he or she is responsible for paying damages to cover your medical bills, but the defendant does not have to pay those bills as you incur them over time.

Car Accidents in No-fault and Non-no-fault States

Your medical bill payment responsibility depends on whether you have your car accident in a no-fault state or a non-no-fault state.

With no-fault car insurance, your own insurance company will be obliged to pay some of your medical bills after a road accident, up to a certain limit, regardless of who caused the accident. If your medical bills exceed the no-fault limit of the state, you must pay the additional amount.

But if you have health insurance, your medical bills should be covered by your health insurance; or by Medicare or a program like Medicaid.

Furthermore, in no-fault states, if your medical bills exceed a set amount, or if your injuries are severe, you are able to file a traditional liability claim against the driver that caused the accident. However, that will take time to resolve, which means you still need to find the money to cover your additional medical costs in the meantime.

In states without no-fault insurance, you will usually be responsible for paying your medical expenses as you incur them. Though, in some non-no-fault states, drivers can have Medical Payments Coverage, which is more commonly known as MedPay.

The coverage will pay for your medical bills up to a certain amount. After medical bills exceed the policy limit, you will be responsible for covering the costs. If you or the other driver does not have MedPay coverage and you are injured, you will be responsible for paying your medical bills.

Summing Up

Your medical bill payment responsibility after a car accident is a little complex, but you should now have a much clearer idea of when you do and do not have to pay for your medical costs after being injured in a road accident.

As long as you remain alert and focused when driving and follow the rules of the road at all times, you will lessen your risk of being involved in a car accident. But auto accidents can happen anytime and anywhere, so you should look at getting the best insurance coverage you can.