Your guide to knowing everything about bad debt as a business owner

In today’s world, there is constant competition for entrepreneurs and small business owners. For this reason, every financial decision must be scrutinized.

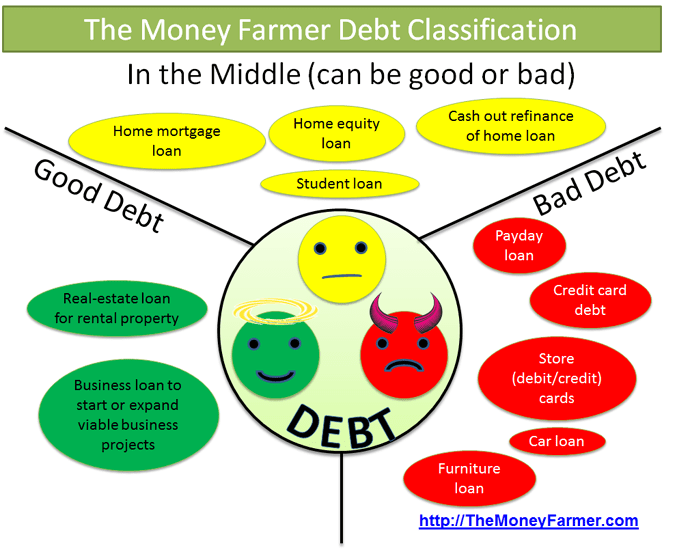

One area that can be a bit confusing is understanding when to take on debt. As the saying goes, “there is a difference between good debt and bad debt”, but how can you tell the difference?

In this article, we discuss the differences between good debt and bad debt. Let’s dive in!

The Difference Between Good Debt and Bad Debt

Most people immediately think that debt is a bad thing. You shy away from debt and pay it off like a gazelle running from a lion. You know the adage.

But, business owners have a different playbook when it comes to debt, and many successful businesses are built on it.

Now, how do you know what’s a good debt deal and what’s a bad deal?

Good debts are debts that help your business grow. This means increasing purchase orders and expanding your customer base through marketing.

On the other hand, bad debt refers to the kind of debt that does zero for increasing your wealth.

In fact, bad debts can eat away at your profits. For instance, bad debt may be taken for personal expenses, such as paying grand credit card bills or other luxuries.

Hence, it becomes essential to differentiate between good debt and bad debt. Given below are some effective tips on how to do so.

How to Avoid Bad Debt?

1. Differentiate Needs from Wants

If you think clearly about an issue, you should be able to determine if a purchase is a need or want.

Remember that out of the 100 things that you want, there are only two to three things that you genuinely need. So, while you’re in the process of establishing a business, make sure you only focus on your needs.

For instance, you may want a delivery truck with all your advertising on the side panels. True, it would be great to maybe gain some leads by simply driving down the street. But, if you simply can’t afford it at the moment, you can always make deliveries without advertising visible on the truck!

2. Know Your Finances

Before you buy anything, you must know the state of your finances. A software solution like Quickbooks can help you, but you should know your finances forward and backward.

Before making any financial decisions, plug the new numbers into your budget and ask yourself hard questions.

3. Be Clear with Your Clients

Sometimes, a business person might carry debt to float between payments from clients. Using their credit card between payments for necessities and new inventory. To avoid this issue, entrepreneurs should be upfront about due dates and late payment fees.

In order to have a strong stance and be confident, you need to be organized. Document all your transactions with clients and keep spotless records. Stay engaged with your client through the workflow process. Don’t let a client feel like they can just sit on your invoice!

4. Qualify Each Expense and Decision

Now, we don’t advise being cheap, but you should look into every expense and make sure that it makes long-term financial sense.

Are you considering opening a second location? Have you done your due diligence on the area? Did you hire a commercial real estate agent who can direct you toward the best location? Is now the best time to update your logo? What are the downstream effects? Will customers still recognize your marketing?

You can only make sound financial decisions for your business when you ask good questions.

Final Thoughts

Bad debt is one of the major reasons why businesses big and small have gone under. A successful business one year can be in trouble the next if finances are not managed shrewdly.

Avoiding bad debt is just the tip of the iceberg, but it might keep your business afloat when times get rough!